2010 BUBU ROBOTFOREX BOBBYTRAP

ADS2

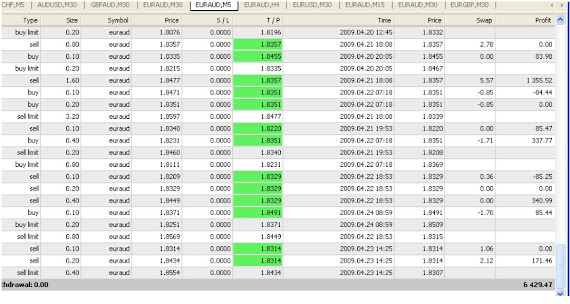

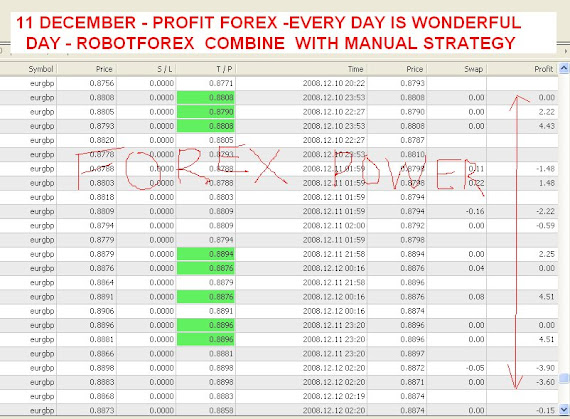

PROFIT 40% PERMONTH USING BUBUFOREX @ BOBBYTRAP ROBOTFOREX

40% PROFIT IN ONE MONTH

PROFIT 60% IN 17 DAYS ONLY

40 PERCENT IN ONE MONTH

ADS1

DUKASCOPY MOVER SHAKERS

NEW ROBOTFOREX REVOLUTION

NOW .....IN 2010

IN 2010 , WE HAD CREATED A ROBOTFOREX WHICH WILL GENERATE AVERAGE 1000 USD PER WEEK PROVEN BASE ON MINIMUM DEPOSIT LEVEL 2500 USD . IN COMING YEARS ...WE WILL FOCUS USING THIS new ROBOT STRATEGY ... NO MORE MARGIN CALL USING THIS LATEST ROBOT ..WE CALLED IT '"" BUBU ROBOTFOREX " OR " BOBYTRAP ROBOTFOREX "

BOBBYTRAP ROBOTFOREX

BOBBYTRAP ROBOTFOREX OR BUBU ROBOTFOREX 2010

BOBBYTRAP FX ROBOT

NEW ROBOT MACD , MAKE 100% PROFIT TRADE

LATEST ROBOT TREND MACD 100% PROFIT TRADE , 0% DRAWDOWN

ROBOTFOREX GBP/JPY WAS BORNED

GBPJPY RESULT POWER ROBOTFOREX LATEST

SEMINAR FOREX -KOTA BHARU in MALAYSIA

SEMINAR FOREX - KOTA BHARU

GBPJPY TRADE BY ROBOT PROFIT 10,182 USD IN 11 DAYS

ROBOTFOREX NEW STRATEGY FOR MOST VOLATILE PAIR GBP/JPY

HIGHER VOLATILE HIGHER PROFIT

WE CAN DO IT BECAUSE WE ALWAYS MOVE AND CHANGE TO THE NEXT REVOLUTION IN FOREX TRADING .

ROBOTFOREX FOR YEN JAPAN PROFIT 7383 USD ONLY IN 10 DAYS TRADING NON STOP

MIG TRADE GBPJPY PROFIT 7963 USD IN 10 DAYS TRADING

DEMO GBPJPY POWERFULL VY ROBOT

GOING UP EUR/AUD

EUR CHF STABLE PAIR

ROBOTFOREX WILL TRADE FOR YOU GET DAILY PROFIT

SECRET TO RICH VISUALIZATION VIDEO

ROBOTFOREX TRADE FOR YOU

OPEN FOREX.COM

The best way , I recomended you/ friend to open account mini/micro lot with FOREX.COM UK under GAIN CAPITAL GROUP 3rd LARGEST BROKER IN THE WORLD . Please clik link below and fill up simple form under INTRODUCING BROKER (IB) . CLIK below link to open account forex.com under refering IB .

AFTER That you will be forward to ONLINE SECURE APPLICATION FORM and fill up to complete the form .

2) You need to fill up the info include personal detail , remark self managed , need to upload document ID and utility bill and Signature page form into their Online SECURE APPLICATION form . You will have login code and after approval account , you will get account no and Online secure login to manage your forex account . . They are using server GAIN in USA but the account number will be manage under FOREX.COM UK which regulated by FSA in UK .

After complete the application form at FOREX.COM UK , please email and inform to: MONEYMANAGER at : moneymanager77@gmail.com , that you have apply the account and we will arrange the rebate for the trading volume in forex.com UK later for you to be paid to your paypal account .

You can create a paypal account through my referal link here

https://www.paypal.com/row/

IB offer rebate every month base on trading volume from your FOREX.COM account . I am refering more than 10 account through this Introducing Broker (IB) . We can get extra support from this IB regarding our forex account .

LOGIN TO YOUR FOREX.COM ACCOUNT HERE

OR HERE https://secure.efxnow.com/myaccount/LANG/ENG/MQUV/Begin.aspx

TQ ROBOT FOREX MANAGER

GROWTH TOBACCO TANAM TEMBAKAU DIKIR CLASSIC SONG FROM KELANTAN

FOREX TRADING INFO GLOBAL

"Few financial industries generate as much excitement and profit as currency exchange. Traders around the world enter trades for weeks, days or split seconds, generating explosive moves or steady flows, and money changes hands quickly at a staggering daily average of a trillion US dollars. Forex profitability is legendary. George Soros of Quantum Fund realized a profit in excess of 1 billion dollars for a couple of days work in September 1992. Hans Hufschmid of Soloman Brothers, Inc. netted $28 million for 1993. Even by Wall Street standards, these numbers are heartstoppers".*

Despite its high trading volume and its fundamental role in the world, the Forex Market is rarely in the media limelight because its method of trading transaction is less visible than the Floor of a Stock Exchange. However, trading on the Foreign Currency Exchange Market is today surging into the public awareness, as flocks of internet traders are attracted by the market's inherent profitability and risk manageability. Add to this the absence of geographic or temporal boundaries and vibrantly active Forex market is open to all players.

* "Trading in the Global Currency Markets", Cornelius Luca, 2000

FOREX USD PERFECT ROBOTFOREX REVOLUTION WAS BORNED

PERFECT ROBOT FOREX TRADING REVOLUTION WAS BORNED, NOW CAN TRADE ON 4 DECIMAL AND 5 DECIMAL PRICE LIKE AT ALPARI UK FXCM UK !!!!!!!!!

ROBOTFOREX ACTION ON 5 DECIMAL ALPARI UK PLATFORM

How Do The Forex Broker Make Money ?

Many beginning Forex traders wonder how the Forex brokers earn their money on the common traders, if they are not casinos. Understanding the basic principles of the brokers’ economics will help traders to distinguish real Forex brokers from the «bucket shop» scams and the ethical companies from the unethical. Here is the list of the most common ways for the Forex broker to earn money:

- Currency pair spreads. The largest source of income for the Forex brokers, spread is the difference between the Bid and Ask rates. Broker can execute your orders without a spread or with a minimal spread, earning the money that you lose for the spread.

- Leveraged spreads. Spreads alone would be too small to be a significant earning source for the brokers. So, brokers offer high leverage. Of course it’s a great tool for multiplying your profit (and also losses), but the spreads are also leveraged. With 1:100 leverage, broker earns 100 times more on spreads than it would without the leverage.

- Overnight swap spreads. Brokers pay the overnight swaps to the trader if the difference between the currency’s interest rates is positive in the trader’s position and get paid from the trader’s account if that difference is negative. But those payments are not symmetrical and they are changed so that the Forex broker would always get the advantage. When someone is selling 1 lot of EUR/USD and another trader is buying the same amount of that currency pair, the latter is earning money on overnight swaps, but the first one is losing the amount that is enough to compensate the second one’s earnings and to «feed» the broker.

- Payment processing commission. On-line Forex brokers don’t charge commission per trade (except Islamic accounts) and often advertise that as a feature. But some brokers charge payment processing fees — they are deducted only when you deposit or withdraw money and usually are quite small and fixed in currency units, not percentage points. Of course, such commissions are too small to be a part of the broker’s profit, but they are enough to compensate at least a part of the broker’s expenses.

- Trading against the trader. The most despised and unethical way the Forex broker can make money is to trade against its customers. And that’s the most profitable way too. Avoid the brokers that earn when you lose. If the spreads are too low, the leverage is insignificant, the overnight swaps are fair and there are no commissions (for payment processing and trading) then the broker is certainly trading against you to make money.

It is one of the most talked-about advantages of trading on the Forex-the commission-free trades! Unfortunately, while we would all like to think that Forex brokers are just out there executing trades for the fun of it, the simple truth is that everyone needs to make money-even the brokers. While they may not charge a traditional commission, brokers on the Forex still make their money whenever trades take place. Brokers actually are compensated in a number of ways, including:

• Buying/Selling Currencies

• Earned interest on deposited funds

• Converting and holding currencies

• Rollover fees

It is in the buying and selling of currencies that brokers make the majority of their money. They make this money in something known as the "spread", or the difference between the asking and bidding price of the currency pair. The "ask" is the price a retail Forex trader would pay for a position. The "bid" price refers to the amount that an investor could then sell the position at.

The smallest unit of measure in Forex trading is known as a pip and it is equal to .0001 (except for the Japanese Yen, which is .01). The difference between the ask and bid price is typically only 3 or 4 pips and this is what the broker makes when buying and selling currencies.

A broker is actually a middleman and never actually charges anyone directly. Instead, a broker purchases a position from a larger investment institution and then sells it to the retail Forex trader while pocketing the difference between the two amounts. For instance, a broker might set the "ask" price at 1.250 and the "bid" price at 1.246. If the investor were to sell the position immediately, then the most they could sell it for would be the "bid" price of 1.246-or a loss of 4 pips. Since the typical Forex transaction is conducted in $100,000 lots, that means that the broker made $40 in that currency exchange.

The spread will vary depending on the broker and the currencies being traded. Typically, the spread averages between 3-5 pips. Unfortunately, brokers are necessary tools in the Forex trading game if for no other reason than the sheer size of the transactions. There is approximately 1.8 trillion dollars exchanging hands on the Forex every day and these transactions are conducted in $100,000 "lots" (there are also $10,000 mini-lots and even micro-lots). Thus, it is typical for Forex transactions to be highly leveraged with most traders only putting up $1,000 (or 1/100) in capital.

Forex brokers will tend to be partners or somehow associated with investment banks and similar institutions. These "backers" actually guarantee the loans used to leverage Forex trades-and without them-none of us could trade on the currencies markets unless we were willing to risk more than the 1% demanded by most brokers.

Yes, the brokers do make money when investors trade on the Forex but they do provide a genuine service. Just be careful to avoid trading too often because although the pips are small-they can disappear quickly especially when investors try to compensate for a loss by turning around and investing before doing their homework. Therefore, be wary of any Forex broker that advocates any form of "day trading" or the like-it's a very, very dangerous strategy to use in the most volatile and fluid market the world has ever known!

GOLD EUR/AUD GRAF

TREND DOWN EUR AUD

NOWADAY TRADER VS TRADER IN HISTORY

MORE FOREX MILLIONAIRES

More millionaires have gained their wealth from the stock market than any other one source. And now, automated currency trading programs like Forex Robot are changing the way profits are being reaped, and those doing the reaping. A market once dominated by professionals is now gaining momentum with ordinary opportunists seeking and gaining wealth thanks to these smart robot programs. Not only are they capable of making profitable buy/sell decisions but they do what humans can't - work 24/7. As long as there is a market open somewhere, robots are trading and turning profits. So while you're making dinner, watching TV, playing golf, and even sleeping, you can be building wealth. And the trend isn't expected to stop anytime soon, if ever. But be careful also with dangerous robot which can kill your forex account .NOW WE HAD DEVELOPED A POWERFULL ROBOTFOREX SYSTEM THAT CAN TRADE 24 HOURS NON-STOP. contact FOREX MANAGER2U NOW TO JOIN ROBOTFOREX TEAM .FULL SLIDE SHOW HERE,

SEE MORE SLIDE SHOW HERE ROBOTFOREX

AFTER RESEARCH. WE WILL COME OUT WITH NEW ROBOTFOREX REVOLUTION SECOND GENERATION WHICH MORE POWERFULL TO GET MORE DAILY PROFIT FOR MANY CURRENCY PAIRS ..WAIT FOR IT !!!!!!!!!!!!!! THE SECOND GENERATION ROBOTFOREX .

WE ARE RUNNING THE NEW PERFECT ROBOTFOREX SECOND REVOLUTION ON REAL ACCOUNT WHICH CAN OPERATE AND PROVEN CAN GENERATE PROFIT CONTINOUSLY DURING FLAT MARKET AND VOLATILE MARKET AUTOMATICALLY AND SIMULTANEOUSLY ADAPT WHEN MARKET BECOME VOLATILE . THE PERFECT ROBOTFOREX WAS BORNED !!!!!!!!!!!

CURRENTLY ALL FOREX BROKER IN USA HAVE TO COMPLY WITH NON HEDGE RULE BY NFA. THERE ARE FEW SOLUTION BY ROBOTFOREX :-

(a) Trading one direction only weather BUY Only or SELL Only.

(b) Shift or move to the NON USA Broker with MT4 which can

use robotforex with hedging allowed . There are 200 forex

broker around the world . You can choose the best for you .

You can ask the forex expert to choose the best one.

The perfect robotforex will also perform on 5 decimal forex

broker like ALPARI UK which offer micro lot and hedging .

ROBOTFOREX REVOLUTION 2

GRAF EUR AUD H4

CURRENT GOLD PRICE

CONTACT FOREX MANAGER2U BY YOUR EMAIL FOR MORE INFO

FOREX MONEY IDEA

ROBOTFOREX REVOLUTION PHASE ONE

Gold Prices on the Rise—Keep an Eye on AUD/USD

Golden Trading Opportunities

Gold Prices on the Rise—Keep an Eye on AUD/USD

The bull market for commodities is back. After falling close to 25 percent between mid-May and mid-June, gold prices are on the rise once again. Between the middle and the end of this month, gold prices have rebounded 11 percent. Now that we have also broken back above the key psychologically important $600 mark, the rally could extend all the way up to the $720 high that was reached in mid-May. The Federal Reserve recently hinted that 5.25 percent interest rates could be the top, and in reaction, the US dollar has fallen quite significantly. As an additional byproduct, gold prices are higher as traders reverse their long dollar positions. Gold is not only proving to be a popular anti-dollar position but also a hedge for the impact of rising geopolitical risks and concerns for inflation pressures. However, not many people realize that going long the Australian dollar and short the US dollar offers a similar opportunity but also the unique benefit of earning interest income.

Gold is Becoming the Oil Hedge

With other commodities such as oil, silver, and copper also rebounding, many investors have turned to gold as a hedge for rising inflation. According to recent comments by Barclays Capital as reported by the Wall Street Journal, compared to 1999, institutional money managers have three times the amount of capital tied in commodities at the current moment. In addition, their survey indicates that pension funds and hedge funds are also looking to increase their exposure in gold by 1 to 10 percent. Since gold is being used as a diversification tool, it could stay lifted even if other commodity prices begin to fall. The survey also reports that when it comes to fund based commodity investments, 40 percent of the investments in gold are expected to be kept for three years or longer, and an additional 28 percent plan to hold on for at least 18 months or more. Gold has always been seen as the world’s ultimate form of safe haven investment and the only true form of wealth. With so much uncertainty in the world in terms of economic growth and geopolitics, it is no surprise that many investors, big and small have chosen to hedge their investments through gold.

Economic Risks

The economic risks that have increased the attractiveness of gold as an investment is twofold. The first is the impact of oil which acts as a tax for consumers. As oil prices continue to rise, its potential to impact on growth becomes more significant. The fear is that the current all-time highs in oil will eventually have a more meaningful influence on the pocketbooks of consumers. According to a study by the IMF in 2000, every $5 increase per barrel of oil causes industrial countries as a group to see a 0.3 percentage point fall in real GDP while real demand sees a greater short-term loss of 0.4 percentage points. The impact for the US and Europe tends to be even greater since the industrial country average includes two countries (the UK and Canada) that are net oil exporters. Therefore, the $12 rise in oil since the beginning of the year will probably shave 0.7 percent off of global growth.

The second economic risk is the slide in the US dollar. Many central banks have traditionally parked a lot of their money in the US dollar. However, with the growing current account deficit, the soon-to-be-end to the Federal Reserve tightening cycle, and the uncertainty posed by the housing bubble along with oil, the general belief is that the dollar could fall even further. If this is true, then their dollar-denominated investments could erode significantly as the value of the dollar declines. The fear that any gains in the US stock or bond markets would be erased by a depreciation in the US dollar has been a big reason why many central banks and hedge funds have been looking to alternative places such as gold to park their money.

Political Risks

The biggest hotspots that everyone is talking about at the moment are undoubtedly Iran and North Korea. There have been rumors that North Korea could test a long range missile near Japan while Iran has recently been successful in enriching uranium for the first time. The UN has called for them to halt further deployment, and they have responded by threatening to end UN contacts. Although the UN is still trying to seek a diplomatic solution, the US has not ruled out military strikes. In response, Iran has issued warnings on US interests around the world by saying that they will respond to any blow with “double the intensity.” Meanwhile, Russia has most recently said that they would supply air defense systems to Iran while China continues its plans to secure oil resources in the country. With no resolution in sight and these two big powers taking an interest in Iran, any military engagement by the US could get complicated. Therefore, gold is the best investment in times of geopolitical uncertainties, and this seems to be exactly what traders and investors are doing at the moment.

Currencies in Lieu of Direct Commodities

If you think that gold is going to continue to move higher, the most logical trade is to buy the commodity outright; however, that may not be the best trade. Certain currencies are highly correlated with commodities while requiring less margin and offering the benefit of earning interest. For gold, the closest correlation is with the Australian dollar / US dollar currency pair (AUD/USD). The two products have an 80 percent positive correlation. The margin to hold AUD/USD and to earn interest in a regular account is $2000, which compares to an overnight margin of $2,228 for gold futures. For the mini contracts, AUD/USD requires a margin of $200 compared to $743 for mini sized gold.

The correlation between gold and AUD/USD comes from the fact that Australia is the world’s second largest gold producer behind South Africa so it stands to benefit greatly whenever gold prices rise. However the relationship doesn’t just end there. Australia benefits not only from the rise in gold but also the rise in many other commodities. The country is also a major producer of Copper, Nickel, Aluminum, and Zinc, which are all either at multi-decade or record highs. There is a limited supply of the yellow metal, and with talk of more central banks such as China possibly shifting additional reserves to tangible assets like gold, the commodity could continue to rise. However, a real push towards $850 would require significant weakness in the US dollar and maybe even a global slowdown, which is not out of the realm of possibility given the current risks to the US housing market. What does not require a global slowdown though is China’s continued demand for steel, copper, and zinc. Therefore, the Australian dollar is the real commodity play from the perspective of gold or more industrial metals.

On the flip side, stronger gold typically comes hand in hand with a weaker dollar. If the US economy begins to weaken, giving the Federal Reserve reason to pause in August and then maybe even reason to consider lowering rates shortly after that, the dollar will be punished significantly. During that time, traders will be looking for a safer haven, and in that case, there is no better safe haven than gold itself. Central banks around the world have already been increasing their gold exposure in fear of a dollar collapse. The end of the Fed cycle gives them an even better reason to switch now than later.

Therefore, it makes sense that the AUD/USD has a very strong positive correlation with gold as shown in the graph below. However, the benefit of trading the AUD/USD over gold is that AUD/USD currently offers the ability to earn interest since Australian interest rates are higher than US interest. Furthermore, it offers mild diversification off of the same view, which some traders may find beneficial. Therefore, if you think gold prices will continue to move higher, keep an eye on AUD/USD.

=========================================

By Gabriel Andre

First, on the commodities markets, gold is traded in U.S. dollars (USD). With a constant gold price in USD, a rise of the Australian Dollar (AUD) against the US Dollar (AUD/USD) makes gold cheaper for Aussie investors.

Symmetrically, a decline of the AUD/USD makes gold more expensive for them. This foreign currency (FX) effect (also known by traders as currency risk) is a real matter for local investors.

FX markets in general and the Australian Dollar in particular had impressive volatility in 2008, especially during the second half of the year. If it continues in 2009, you'll want to understand the relationship in order to devise your own gold strategy.

In an analysis of movements of value of gold in Australian dollars and the currency pair of relative values of US dollar and Australian dollar, three distinct phases were visible-

1) Phase 1 from August 2007 to March 2008 where "Aussie Gold" climbed sharply despite the fact that the AUD/USD exchange rate was rising too. It means that at the same time, gold prices in USD were rising faster than the AUD/USD.

In details, it means that, the AUD/USD ( how many US Dollars for ONE Australian Dollar) rose by 11% roughly between September 2007 and March 2008. For the same period, gold (therefore how many US Dollars for ONE ounce of Gold) rose by 31%.

As a result, both the AUD and gold appreciated against the USD, but gold appreciated much faster. That's why the Aussie gold price (how many Australian Dollars for ONE ounce of gold) also climbed sharply. What does it all mean? It means that gold appreciated against AUD!

The Aussie gold price is a function of the velocity of the AUD/USD compared to the velocity of gold. If AUD/USD appreciates faster than gold, then the Aussie gold price declines. If gold appreciates faster than AUD/USD, then the Aussie gold price rises.

2) Phase 2 from March 2008 to September 2008 where the "Aussie gold" was cheaper as gold in USD was correcting while the local currency jumped to historical highs until July, then crashed.

3) Phase 3 from September until now where gold prices on the international markets are consolidating and rising again whereas the AUD/USD has been falling to low levels not seen since 2003. As a result, the "Aussie gold" is soaring.

Since last October, we can see that the Aussie gold price is reaching historic highs. Because of the crash of his currency on the FX markets, a local must pay today $1,250 AUD to buy an ounce of gold. At mid-August last year, the cost for the same ounce was only $917 AUD. It's a 36% increase in 5 months!

What is the conclusion of that?

Well, we have calculated the correlation between gold and the Australian currency, both the strength of their relationship and the degree of their relationship. From 1991 to date, this correlation is equal to 81%. Gold and the Aussie are positively correlated, as they typically move in the same direction because they are both traded against the US Dollar. But they don't move at the same pace. And this is that difference of pace or velocity that drives the Aussie gold price.

On a historical basis, a strong Australian dollar is NOT a 100% guarantee of a cheaper gold for local investors, but it is clearly often the case.

That's why if you want to buy gold, I would suggest you to wait for the Aussie gold price to correct. Currently these are the historical highs. If we have a look at the Aussie gold itself on a weekly basis, the MACD shows that the bullish momentum is likely to be over. It has peaked at unprecedented high levels on early January and has already started to curve downward.

Historically a similar configuration happened twice, in May 2006 and March 2008. If the MACD crosses below its signal line, it would be a clear signal of trend reversal, and would drive the Aussie Gold much cheaper. We will keep an eye on that in the coming weeks!

(Courtesy: The Daily Reckoning, Australia)

FOREX MANAGED GLOBAL OPPORTUNITY

PENGENALAN KEPADA FOREX

Pengenalan Kepada Forex

Kadar tukaran Matawang Asing (Forex) “Trading” mengizinkan pelabur untuk menyertai dan membuat keuntungan berdasarkan naik turun matawang dunia. “Trading Forex” berfungsi dengan memilih gabungan dua matawang kemudian mengaut keuntungan atau kerugian berdasarkan turun naik salah satu harga matawang di pasaran berbanding dengan yang lain. Sebagai contoh, turun naik harga matawang U.S Dollar $ adalah diukur dengan matawang lain seperti £ British Pound, € Eurodollar, ¥ Japanese Yen dan sebagainya. Mampu untuk melihat tren-tren harga dalam kegiatan pasaran adalah intipati semua dagangan menguntungkan dan inilah yang membuatkan mata wang asing sangat menarik, pasaran matawang dunia adalah pasaran yang terbaik.Inilah yang memberikan pelabur-pelabur tukaran mata wang asing peluang untuk membuat keuntungan yang tidak terdapat di pasaran-pasaran yang lain.

“Trading Forex” telah digelar sebagai pelaburan kini yang memberikan peluang keseronokan kepada pelabur “savvy”. Sebab itulah pasaran dagangan tukaran mata wang asing hanya bermula dalam tahun 1978, bila matawang seluruh dunia dibenarkan terapung berdasarkan permintaan dan penawaran, selepas 7 tahun Standard Emas terbengkalai.Selepas tahun 1995, “Trading Forex” hanya dibenarkan kepada bank-bank dan perbadanan multinasional besar,tetapi pada hari ini,tahniah kepada percambahan komputer dan satu era baru bagi internet berpangkalan teknologi-teknologi komunikasi, pasaran yang menguntungkan ini terbuka kepada semua orang.

Tidak seperti dagangan tradisi yang mengkehendaki pembeli dan penjual berada di lokasi yang sama (“trading floors”) tetapi di forex “Trading” mereka tidak perlu untuk berada di lokasi yang sama. Forexa dalah sebuah pasaran di mana peniaga-peniaga di seluruh dunia menjalankan perniagaan yang disambungkan dengan rangkaian internet yang berkelajuan tinggi yang menghubungkan dengan Interbank Foreign Currency Exchange via Forex Clearinghouses (juga dikenali dengan Firma Broker Forex). Forex bukan sahaja dikenali dengan pasaran pertumbuhan yang paling pesat tetapi juga sebagai tempat pasaran yang PALING MENGUNTUNGKAN SEKALI DI DALAM DUNIA INI.

Dalam erti kata lain, Forex adalah yang paling menguntungkan kerana ia adalah pasaran terbesar dunia. Pasaran matawang asing adalah akaun keseluruhan bagi 4 Trillion dollars yang didagangkan setiap hari (seperti yang dinyatakan oleh Central Bank Survey of Foreign Exchange yang ke empat dan Derivatives Market Activity, 1998. Angka ini dikatakan telah meningkat pada hari ini.) Bagi meletakkan ke dalam perspektif, di mana-mana hari diberi kegiatan pasaran pertukaran matawang asing adalah jauh lebih hebat daripada pasaran saham. Ia adalah 75 kali lebih besar daripada New York Stock Exchange di mana jumlah nilai purata keseluruhan sehari ( menggunakan rajah 1998) bagi kedua-dua pasaran saham asing dan dalam negeri adalah $16 bilion, dan lebih hebat lagi daripada aktiviti harian di bursa saham London, dengan $11 bilion.

Tambahan pula, sebagai penambahan untuk menjadi pasaran yang terbesar dan menguntungkan, pasaran Forex adalah yang paling berkuasa dan pasaran dagangan berterusan tanpa mengira petunjuk ekonomi negatif. Ini adalah kerana tren matawang yang lebih baik dari pasaran lain berdasarkan sifat makro-ekonomi mereka. Tidak seperti komoditi lain yang membuat penawaran dan permintaan yang boleh berubah dalam tempoh semalaman ( seperti yang dijumpai di “sudden dot com” ‘market adjustment’ dan lebih mengejutkan lagi pada 11 September, 2001), asas-asas matawang adalah kurang rawak, dan jauh boleh diramalkan. Ini adalah ilustrasi sihat dalam kadar faedah yang bertukar secara beansur-ansur dan hanya mengalami kenaikan yang kecil.

Contoh lain yang boleh diramalkan ialah ilustrasi bagi statistik berikut. Bagi $1.2 trilion dagangan sehari dalam pertukaran matawang asing, 83% melihat aktiviti pertukaran asing dan 95% swap beraktiviti melibatkan US Dollars. Euro adalah mata wang kedua yang paling aktif pada 37%. Yen Jepun (24%) dan British Pound Sterling (10%) adalah tempat ketiga dan keempat. Swiss franc ialah 17% dan

“Spot Forex” adalah sejenis “Forex trade” yang dimana para “trader” menumpukan kepada aktiviti pelaburan dengan alasan yang telah jelas dengan sendirinya. Maksud transaksi “Spot Forex” adalah dimana transaksi “trade” matawang dijalankan dengan maksimum 2 hari bekerja diikuti dengan penutupan “trade” tersebut. Walaubagaimanapun “Spot Forex” membenarkan seorang “trader” yang mempunyai kecairan modal yang tinggi. Satu lagi ciri yang popular ialah dimana seorang “trader” yang mempunyai potensi dengan keuntungan yang tinggi apabila mereka membeli satu matawang khusus apabila ia dalam keadaan lemah dan menjual kembali apabila ia kembali kukuh dan berterusan untuk matawang yang kukuh menandingi matawang yang lemah. Potensi untuk untung dan rugi bergantung pada kesan daripada “leverage”. “Leverage” adalah dimana sejumlah wang yang kecil mengawal sejumlah wang yang besar. Sebagai contoh, faktor “leverage” 100 boleh membenarkan seseorang “trader” itu memegang posisi 100,000 US Dollar hanya dengan modal 1,000 US Dollar margin. Ini adalah kerana “Spot Forex” boleh mengawal risiko bagi kemasukkan dan pengeluaran “trading” dan ditambah dengan potensi untuk menjana keuntungan yang tinggi.

"Few financial industries generate as much excitement and profit as currency exchange. Traders around the world enter trades for weeks, days or split seconds, generating explosive moves or steady flows, and money changes hands quickly at a staggering daily average of a trillion US dollars. Forex profitability is legendary. George Soros of Quantum Fund realized a profit in excess of 1 billion dollars for a couple of days work in September 1992. Hans Hufschmid of Soloman Brothers, Inc. netted $28 million for 1993. Even by Wall Street standards, these numbers are heartstoppers".*

Walaupun mempunyai isipadu yang tinggi dan peranan yang besar di dunia, Namum pasaran Forex adalah jarang menjadi tumpuan dari media kerana cara urusniaga nya yang tidak dapat dilihat berbanding dengan Bursa saham, namun urusniaga di pertukaran matawang asing ini semakin mendapat kesedaran dari umum, kerana ia adalah pasaran yang menguntungkan dan mempunyai kawalan risiko. Tambahan ianya pula tiada ganguan geografi dan tanpa sempadan, dengan senang Forex boleh dan dibuka kepada semua orang.

* "Trading in the Global Currency Markets", Cornelius Luca, 2000

MONEY IDEA WITH FOREX

TRADE BY ROBOT FOREX

PROFIT BY ROBOTFOREX 2

EURO AND AUSTRALIAN DOLLAR CURRENCY TRADE

SYDNEY OPERA HOUSE

DAILY PROFIT BY ROBOTFOREX2

3 MONTH REPORT TRADE BY ROBOTFOREX

FOREX 30K

ROBOTFOREX NEVER GIVE UP

ROBOTFOREX GENERATE PROFIT DAILY NON-STOP

FOREX MONEY

AUD EURO CHF CURRENCY

4 TRILLION FOREX MARKET 200 GLOBAL FOREX BROKER

10,000 DOLLAR FOREX MANAGED BY FX MANAGER2U

BUY FOREX SELL FOREX

FOREX NEWS

MARKET NEWS 13/05

US Dollar: Comments of the FRS President, Ben Bernanke, who stated on Monday, that the American dollar would still be considered the principal world currency, increased the confidence of the market participants.

The US trade balance, which was published on Tuesday, amounted to - $27.6 billion dollars, instead of -$29.2 billion dollars according to the forecasts. This fact reinforced the investors’ optimism.

Euro: Due to the increased willingness of the market participants to take risks and released positive fundamental news, the EUR/USD pair established its maximum around $1,3670.

British Pound: Promising fundamental news from the Great Britain rendered positive impact on the British pound. Particularly, the monthly and yearly manufacturing production data demonstrated a much better results, than forecasted.

The GBP/USD pair established its session maximum in the range of $1,5335.

Japanese Yen: The USD/JPY pair traded in the range of Y97.05 – Y97.65.

Oil: The oil prices continued to consolidate on Tuesday.

Gold: Due to the weakened dollar on Tuesday, the gold rate had a confident upwards movement and reached the level of $925.80 per ounce.

Silver: Following the gold rate, silver prices demonstrated a sharp increase as well.

- Market review for 04 – 08. 05, 2009

On the first day of the trading week due to the speculations regarding the weakening of the financial crises, the shelter-currencies turned out to be under pressure. But at the same time the market participants were expecting the results of the 19 leading US banks’ stress-tests, and were pressured by the expectations that not all the banks would pass this test. On Monday after the negative fundamental news, published in Euro zone, the European currencies turned out to be under pressure. Particularly, the retail sales data in Germany demonstrated a much lower level, then forecasted. And the EUR/USD pair dropped to the session minimum in the range of $1.3222. But by the end of the day the European currency managed to rehabilitate, since the market participants showed their willingness to take risks. Consequently, the Japanese yen continued to drop against the major currencies, since the demand for the low-risk assets decreased.

The oil prices grew thanks to the weakened dollar. The data regarding the decreased oil OPEC inventories due to the extraction interruptions in Nigeria influenced the increased oil prices as well. And the gold rate exceeded the $900.00 level.

On Tuesday the published statement of the FRS President, Ben Bernanke, that the US economy decline rate slowed down, rendered some support to the American dollar. And the drop of the monthly and yearly Euro-zone production price index for March had a negative influence on the euro dynamics. But due to the European stock market growth, the euro currencies rehabilitated temporarily, and the EUR/USD pair demonstrated its daily minimum at the level of $1.3320, but then regained its positions to the $1.3396 mark.

On the same day in accordance with the forecasts, the Australian Central Bank left the principal interest rate unchanged at the level of 3%, which did not have any impact on the trading dynamics.

On Tuesday the gold price dynamics was diversified. The “yellow metal” was supported by the speculations regarding the increased gold reserve in China and by the suspicions of the stress-test results. At the same time the gold rate was under pressure after the rehabilitation of the American dollar.

At the beginning of the trading session on Wednesday, the American dollar started strengthening as a shelter-currency due to the market participants’ unwillingness to take risks. This was a consequence of the negative stress-test results’ expectations. Therefore, the EUR/USD pair dropped to the $1.3240 level. At the same time, rather promising fundamental news were published in the US. Unexpectedly, the ADP employment change turned out to be considerably better, then the forecasts. And the EUR/USD pair increased temporarily to $1,3373.

In the middle of the week the oil rate reached the level of $55,53 per barrel after the published information regarding the slow-down of the oil inventories rate growth in the US.

During the first part of the day on Thursday, the US Minister of Finances, Timothy Geithner, confirmed that none of the tested banks would be threatened by the bankruptcy. This information had a strengthening impact on the American dollar. According to the experts’ prognosis, the ECB reduced the principal rate for 25 basic points till the level of 1,00%. The factory orders in Germany, which were published on Thursday, unexpectedly demonstrated a much better results, than forecasted. Therefore the euro dynamics changed to the positive direction. The EUR/USD pair established a maximum at the level of $1,34. According to the expectations as well, the Bank of England left the principal rate unchanged at the level of 0,50%. And the announcements regarding the increasing purchase volume of bonds in Great Britain had a negative impact on the sterling.

During the whole week the silver rate demonstrated a more significant increase, then the gold rate.

On Friday in accordance with the expectations, the change in the US non-farm payrolls demonstrated better results, compared to the forecasts, which rendered support to the high-yielding currencies.

Happy trading!

EDW PROFIT FOREX

WELCOME TO FOREX MANAGER2U

1- Client Owned Account: You have total control of your trading capital. FOREX MANAGER cannot withdraw any funds and will only have trading authority through the Limited Power of Attorney.

2-Transparency: You can see the account history, trade history and account summary in real time 24/7.

3- Constant Operation: FOREX MANAGER can trade while the market is open 24 hrs (5.5 days p/week) so you don’t have to.

4- Quantitative Trading System: FOREX MANAGER utilizes quantitative trading algorithms for precise entry and exit prices that change dynamically with the market.

5-Risk Management: FOREX MANAGER’s trading algorithms are designed to mitigate risk through multiple currency pairs across several time frames.

6-Low Minimum Investment: $5000 is the minimum investment for the FOREX MANAGED program.

7- Tool for Diversification: A mechanism for investor’s to diversify there portfolio from economically sensitive investments like bonds, mutual funds and real estate to recession proof investments of world currencies.

FOREX ROBOT TRADE

FOREX PROFIT

PROFIT TRADE BY ROBOTFOREX

ROBOT TRADE

FOREX TRADING PHYLOSOPHY AND OBJECTIVE

The goal of building long-term wealth through investing can be best achieved by consistently employing a disciplined investment process having a demonstrable statistical “edge” at a level of risk that ensures capital is never eroded to such an extent that the investor loses faith in the process.

FOREX MANAGER2U believes that a well designed trading system which has been developed to suit the investor’s risk tolerance is a necessary component of a successful investment process. A trading system represents a set of rules for making entry, exit and position sizing decisions. These rules may be mechanical and objective or they may be discretionary and subjective. We prefer the former over the later because:

- The system can be back tested on historical market data not used in development. If the system has been well designed, sufficient testing should reveal a worthwhile mathematical expectation of profit.

- The worst-case potential of capital erosion (drawdown) can be estimated in advance, allowing the investor to assess if such a system can meet his objectives or if modifications are required.

- Judgment errors are minimized and can only arise when the investor fails to follow the system – an unlikely event if the system has been developed with the investor’s psychology in mind.

We have incorporated a number of beliefs in our trading and risk-management system. These are summarized below:

- A trading system must have a worthwhile mathematical expectation of profit if it is to be successful.

- Proper position sizing is essential to achieving success. If you risk too little, you will not meet your longer-term performance objectives. On the other hand, risking too much may result in your being “terminated from the game” during those inevitable periods when you suffer an extended drawdown in performance. There has been as much time in system development should as on position sizing within the algorithms.

- Most investors place entirely too much emphasis on being right. It’s not whether you’re right or wrong that is important, but how much money you make when you’re right versus how much you lose when you’re wrong.

- You must be willing to lose in order to win. A trading system can be profitable even if it generates winning trades less than 50% of the time. In fact, many profitable trading systems generate winning trades only 30-40% of the time.

- Successful investing is 40% risk control and 60% self control. As such, the investor’s psychological profile may be the most important factor in contributing to investment results. Therefore, it is reasonable to conclude that an automatic trading philosophy becomes a paramount element in the trading system to reduce subjectivity and increase objectivity in the ever changing market conditions.

- Risk orientation and conservatism are often considered opposing personality traits. Both are essential to achieve good performance. Our objective is to take the risk-oriented part of our personality and put it where it belongs: taking the trading signals. The conservative part of our personality also must be put where it belongs: proper position sizing.

- Through diversification, we can smooth the equity curve and increase opportunity. Diversification can be achieved in two ways: (1) using multiple trading systems on the same market, each designed to capture a different market characteristic and/or different time frames; and (2) trading multiple markets with the same system.

- The easier a system is to trade, the less robust that system is likely to be over the long term, However, a well designed system that is compatible with the investor’s psychology and trading beliefs, and which has been thoroughly tested and is well understood, will likely be more easily implemented than one which has not met this criteria.

A successful investment process consists of more than just a good trading system. We believe that a healthy attitude resulting from a through understanding of the investor’s psychology is crucial both in the development of the trading system and its ongoing implementation. The weak link in the process requires a well thought out investment plan covering all aspects of the process from the minimum capital required to make the process work through to a disaster recovery plan.

FOREX TRADING STRATEGIES

Planning Forex trading strategies

Forex trading strategies are based on fundamental and technical types of analysis. This article gives you a better understanding of both types and ways of implementing them into your Forex trading strategies.

FUNDAMENTAL ANALYSIS

Political and economic changes are the basis here as they frequently affect currency prices. Traders relying on this analysis gather information about unemployment forecasts, political ideologies, economic policies, inflation and growth rates from news sources. Most traders combine Forex trading strategies to plot actual entrance and exit points and double-check the information.

Forex trading strategies consider that just like most markets the market is controlled by supply and demand. The two most critical affecting factors for them are interest rates and the strength of the economy that is affected by changes in the GDP, trade balances and the amount of foreign investment.

There are many indicators released by government and academic sources on a weekly or monthly basis. The most important and commonly followed are: interest rates, international trade, CPI, durable goods orders, PPI, PMI and retail orders. These are pretty reliable measures of economic health and are closely followed by all traders that rely on fundamental analysis while mapping out their Forex trading strategies.

Interest rates can strengthen or weaken the currency. In some cases high interest rates attract foreign money, however high interest rates frequently cause stock market investors to sell off their portfolios. They do so believing that the higher cost of borrowing money will adversely affect many companies. If enough investors sell off their holdings it can cause a downturn in the market and negatively affect the economy. Which of these two effects will take place, depends on many complex factors. Usually economic observers agree on how the current change in interest rates will affect the general economy and currency prices.

International Trade. If there is a trade deficit, it is usually considered a negative indicator, as more money is leaving the country than entering it. This can have a devaluing effect on the currency, but usually trade imbalances are already factored into the market consideration. If a country normally operates with a trade deficit, currency price should be unaffected. It will change if the deficit is greater than expected.

The cost of living (CPI) and the cost of producing goods (PPI) are important indicators as well. You should also watch the GDP (the value of all the goods produced in the country) and the M2 Money Supply which measures the total amount of currency for a country.

In the US alone there are 28 major indicators that have a strong effect on the financial market and should be closely watched. This information can be found on the Internet and is provided by many brokers. Use it for working out your Forex trading strategies.

TECHNICAL ANALYSIS

It is based on the following assumptions:

1. Combined market forces (political events, economic conditions, seasonal fluctuations, supply and demand) cause currency price movements considered in Forex trading strategies.

2. Currency prices on the Forex market follow trends. Predictable consequences have been linked with many recognized market patterns.

3. Forex trading strategies can rely on historical trends to predict current price movements. Forex market data has been collected for the last 100 years, over that time certain patterns have become emergent. Human psychology and the way people react to certain circumstances are the basis of these patterns.

Most traders consider technical analysis to be of critical importance even though they may also use fundamental analysis to support and confirm their Forex trading strategies. Unlike fundamental analysis, technical analysis can be applied to many currencies and markets at the same time. Since fundamental analysis requires detailed knowledge of the economic and political conditions of a certain country, it is nearly impossible for any single trader to perform it properly on more than a few countries.

Forex beginners may consider the complexities of technical analysis overwhelming and even unnecessary but if you wish to ensure the success of your Forex trading strategies do not ignore both analysis types.

Any quality online Forex broker should be able to supply you with a large variety of online charts for technical analysis. Working out your Forex trading strategies, you can purchase in-depth professional charts, there is usually a monthly fee involved in gaining access to this information. There is also free software available to help you with charting. Good charts are updated in real time.

Mapping out your Forex trading strategies, you should learn the market and study trends before you begin active trading. Most brokers will provide you with a practice account where you can place "paper trades" - practice trades where no real money is made or lost. But they act just like a real trade, so you can see exactly how your trade would have turned out if you had placed it for real. This allows you to become familiar with your broker's system as well as learning about the market without risking any money.

The second part of this article explores various charts and indicators you need to use while planning your unique Forex trading strategies.

READING FOREX CHARTS

Price charts can be simple line, bar or even candlestick graphs. They show prices during specified time intervals that can be anywhere from minutes to years.

Line charts are the easiest to read, they give a broad overview of price movement. They only show the closing price for the specified interval and make it easy to pick out patterns and trends.

With a bar chart the length of a line displays the price spread during the time interval. The larger the bar, the greater the price difference between the high and low price for that interval. It is easy to tell at a glance if the price rose or fell, because the left tab shows the opening price and the right tab the closing price. Then the bar will give you the price variation.Pprinted bar charts can be difficult to read but most software charts have a zoom function so you can easily read even closely spaced bars while mapping out your Forex trading strategies.

Candlestick charts are very similar to bar charts - they both show high, low, open and closed prices for indicated time periods. Originally developed in Japan for analyzing candlestick contracts, they are very useful for analyzing Forex prices and are therefore a handy "tool" in Forex trading strategy planning. However the color coding makes it easier to read the chart, green candlestick indicates the rising price and the red - the falling price.

The actual candlestick shape in reference to the candlesticks around it will tell you a lot about the price movement and will greatly aid your analysis. Depending on the price spread various patterns will be formed by the candlesticks. Many of the shapes have exotic names, but once you learn the patterns, they are easy to pick out, analyze and use while working out your Forex trading strategies.

Price charts are not usually used alone. To get the full effect, you need to combine them with some technical indicators: trend, strength, volatility and cycle indicators. The most commonly used indicators are:

Average Directional Movement Index (ADX) helps indicate if the market is moving in a trend in either direction and how strong the trend is. If a trend has readings in excess of 25 then it is considered a stronger trend. Effective "tool" when planning your Forex trading strategies.

The Moving Average Convergence/Divergence (MACD) shows the relationship between the moving averages which allows you to determine the momentum of the market. Any time that the signal line is crossed by the MACD it is considered to be a strong market.

The Stochastic Oscillator compares the closing price to the price range over a specific time frame to determine the strength or weakness of the market. If a currency has a stochastic of greater than 80 it is considered overbought. However, if the stochastic is under 20 then the currency is considered undersold.

The Relative Strength Indicator (RSI) is a scale from 1 to 100 that compares the high and low prices over time. If the RSI rises above 70 it is considered overbought where as anything below 30 is considered oversold.

The Moving Average is created by comparing the average price for a time period to the average price of other time periods.

FAQ TO FOREX MANAGER2U

| |

| |

| |

| |

|

INTRODUCTION TO FOREX

Foreign Currency Exchange (Forex) Trading allows an investor to participate in profitable fluctuations of world currencies. Forex trading works by selecting pairs of currencies and then measuring profit or loss by the fluctuations of one one currency's market activity compared to the other. For example, fluctuations in the value of the $ U.S. Dollar are measured against another world currency such as the British Pound, Eurodollar, Japanese Yen etc. Being able to discern price trends in market activity is the essence of all profitable trading and this is what makes foreign currencies so exciting, currencies are the world's 'best trending' market. This gives Forex investors a profit making edge that is unavailable in most other markets.

Forex Trading is being called 'today's exciting new investment opportunity for the savvy investor'. The reason is that the Forex Trading Market only began to emerge in 1978, when worldwide currencies were allowed to 'float' according to supply and demand, 7 years after the Gold Standard was abandoned. Up until 1995 Forex Trading was only available to banks and large multinational corporations but today, thanks to the proliferation of the computer and a new era of internet-based communication technologies, this highly profitable market is open to everyone. The Forex Trading Market's growth has been unprecedented, explosive, and continues to be unequaled by any other trading market.

Unlike traditional trading which brings buyers and sellers together in a central location (trading floors) in Forex Trading there is no need for a centralized location. Forex is a market where worldwide traders conduct business by high-speed Internet connections with the Interbank Foreign Currency Exchange via Forex Clearinghouses (also called Forex Brokerage Firms). Forex has not only become the fastest growing trading market, but also the most profitable trading marketplace in the world.

Simply stated, Forex is the most profitable because it is the world's largest marketplace. The Foreign Currency market as a whole accounts for over 4 trillion dollars of trading per day (as determined by the fourth Central Bank Survey of Foreign Exchange and Derivatives Market Activity, 1998. This figure is understood to be significantly higher today). To put this into perspective, on any given day the Foreign Currency Exchange Market activity is vastly greater than the Stock Market. It is 75 times greater than the New York Stock Exchange where the average total daily value (using 1998 figures) of both foreign and domestic stocks is $16 billion, and much greater than the daily activity on the London Stock Exchange, with $11 billion.

Furthermore, in addition to being the world's largest and most profitable market, The Foreign Currency Exchange Market is the world's most powerful and persistent trading market regardless of negative economic indicators. This is because currencies 'trend' better than every other market due to their macro-economic nature. Unlike many commodities whose supply and demand fundamentals can literally change overnight (as we found in the sudden dot com 'market adjustment' and even more abruptly on September 11, 2001), currency fundamentals are much less random, and far more predictable. This is well illustrated in the way interest rates are changed gradually and only in small increments.

Other examples of fundamental predictability are illustrated by the following statistics. Of the $1.2 trillion day trading in Foreign Currency Exchange, 83% of spot foreign exchange activity and 95% of swap activity involves US Dollars. The Euro is the second most active currency at 37%. The Japanese Yen (24%) and the British Pound Sterling (10%) are ranked third and fourth. The Swiss Franc is 7%, and the Canadian and Australian Dollars account for 3%.

Spot Forex is the type of forex trade in which self-traders concentrate most of their investment activity for reasons that are self-explanatory. By definition, a Spot Forex transaction is a currency trade transaction that has a settlement (liquidation) within a maximum of 2 working days following the closing of the trade. Therefore Spot Forex allows the self-trader high liquidity. Another popular feature for well-advised Spot Forex self-traders is the strong profit potential from continual market fluctuations by buying a specific currency when it is weaker and selling it when it is stronger, and the continual pairing of strong currencies against weak ones. This potential for profit or loss is amplified by the effect of leverage. Leverage is a term that describes what can be achieved when a smaller amount of money controls a much larger amount of money. With regards to Forex Trading for example, a leverage-factor of 100 can allow the trader to hold a 100,000 US Dollar position with a modest 1,000 US Dollar margin deposit. Online Forex day trading focuses its investment activity largely on Spot Forex because of the 'risk manageability' of in-and-out trading plus the potential to generate excellent and highly liquid profits.

"Few financial industries generate as much excitement and profit as currency exchange. Traders around the world enter trades for weeks, days or split seconds, generating explosive moves or steady flows, and money changes hands quickly at a staggering daily average of a trillion US dollars. Forex profitability is legendary. George Soros of Quantum Fund realized a profit in excess of 1 billion dollars for a couple of days work in September 1992. Hans Hufschmid of Soloman Brothers, Inc. netted $28 million for 1993. Even by Wall Street standards, these numbers are heartstoppers".*

Despite its high trading volume and its fundamental role in the world, the Forex Market is rarely in the media limelight because its method of trading transaction is less visible than the Floor of a Stock Exchange. However, trading on the Foreign Currency Exchange Market is today surging into the public awareness, as flocks of internet traders are attracted by the market's inherent profitability and risk manageability. Add to this the absence of geographic or temporal boundaries and vibrantly active Forex market is open to all players.

* "Trading in the Global Currency Markets", Cornelius Luca, 2000

UNDERSTANDING FOREX

Forex trading education

Forex trading education helps you to get fundamental information about market peculiarities.

CURRENCY PAIR

Reading a foreign exchange quote may seem confusing at first. However, it's really quite simple if you remember two things when starting your Forex trading education:

1) The first currency listed is the base currency

2) The value of the base currency is always 1.

The US dollar is the centerpiece of the Forex market and is normally considered the 'base' currency for quotes. In the "Majors", this includes USD/JPY, USD/CHF and USD/CAD. For these currencies and many others, quotes are expressed as a unit of 1 USD per the second currency quoted in the pair. For example, a quote of USD/JPY 120.01 means that one U.S. dollar is equal to 120.01 Japanese yen.

When the U.S. dollar is the base unit and a currency quote goes up, it means the dollar has appreciated in value and the other currency has weakened. If the USD/JPY quote we previously mentioned increases to 123.01, the dollar is stronger because it will now buy more yen than before.

The 3 exceptions to this rule are the British pound (GBP), the Australian dollar (AUD) and the Euro (EUR). In these cases, you might see a quote such as GBP/USD 1.4366, meaning that one British pound equals 1.4366 U.S. dollars.

In these three currency pairs, where the U.S. dollar is not the base rate, a rising quote means a weakening dollar, as it now takes more U.S. dollars to equal one pound, euro or Australian dollar.

In other words, if a currency quote goes higher, that increases the value of the base currency. A lower quote means the base currency is weakening.

Currency pairs that do not involve the U.S. dollar are called cross currencies, but the premise is the same. For example, a quote of EUR/JPY 127.95 signifies that one Euro is equal to 127.95 Japanese yen.

When continuing your Forex trading education, you will often see a two-sided quote, consisting of a 'bid' and 'offer'. The 'bid' is the price at which you can sell the base currency (at the same time buying the counter currency). The 'ask' is the price at which you can buy the base currency (at the same time selling the counter currency).

PIP

Once you start your Forex trading education, you will learn to love this word because it is what you will be seeking for the rest of your Forex career. A pip is the smallest denominator of a particular currency pair, so for the above example, if the EUR/USD moves from 1.2150 to 1.2155 then it has moved up 5 pips.

LEVERAGE

Leverage is a simple concept of Forex trading education. If you have $10,000 to trade with, your Forex broker will let you borrow money from him so that you can trade in larger quantities. They will let you borrow as much as 400 times (400:1) what you put up in a trade. Most brokers allow between 50:1 and 100:1 margin. So, if you put up $1,000, and your broker allows 100:1 margin, then you'll be trading $100,000 worth of currency (instead of $1,000).

That's important, because every pip equals a certain dollar amount. When you trade $10,000, each pip movement equals $1. The chart below shows how it goes from there. If you trade 10,000 worth of currency, each movement would be equal to $1. So if you bought at 1.1445 and sold at 1.1545, you would make 100 x $1, or $100. If you trade $100,000, each pip movement would equal $10 and so on.

LONG AND SHORT

There are 2 different ways to trade on the Forex market and many beginners (or those who continue their Forex trading education) are surprised to learn that they can actually make as much money when currency price moves down as when it goes up. Let's start with the most logical movement, when the price moves up.

Most people are very familiar with the concept of buying something at a low price and selling it when the price increases. So the concept of buying the EUR/USD at 1.2150 and selling it at 1.2160 for a 10 pip gain should seem logical. This process is called going long.

You can also do this in reverse! If you know that the currency price is more likely to go down rather than up, you can go short. This is just the opposite of the above transaction, selling it first and buying it back later in the hope that the price will go down for you to make profit.

This may seem strange at first, but the concept remains the same either way. You always want to buy something at a low price, and sell it expensive. The consecution of actions doesn't matter. You must both buy and sell; as long as you sell at a higher price than you buy you make profit. Let us continue our Forex trading education.

SPREAD

The difference between stock markets and the Forex market brokers, is that in the Forex market, broker commissions are either very low or zero. So how do the ?? make money? They make it from the "spread" - difference between the actual price and the offered price through a broker.

On the right you can see a typical board of currency pairs and their spreads. This one is taken from our feed this morning, and you can see the difference between the Offer (the price you can place on a sell order) and the Bid (the price you can place on a buy order) is 3 pips (the spread).

What does this mean to you though? Well, let's look at the board. If you bought the EUR/USD at 1.2158 as it is offered under the Offer column, and immediately sold it again before the price moved, you would only get 1.2155 as is shown in the Bid column. So the net result is -3 pips, or a loss to you, and a profit to the broker. Remember to always take the spread into account when placing a trade, setting targets and stop losses.

BEARS AND THE BULLS

Once (you have) started your Forex trading education, you will constantly see the terms "Bears" and "Bulls" in Forex books and chat rooms. These are terms that describe the general mood of the market. A "bear" market, is when the general mood of the market is down, i.e. when there are more sellers than buyers in the marketplace. A "bull market" is the opposite, when there are more buyers than sellers and the general mood of the market is up. Forex is a place where bulls and bears struggle, and if you can identify who is gaining the upper hand, then you can identify the direction of the price. Easier said than done, of course. There are many more areas to cover, this should help those only starting Forex trading education.

CALCULATING PROFIT AND LOSS

Forex market, is an around-the-clock cash market where the currencies of nations are bought and sold. Forex trading is always done in currency pairs. For example, you buy Euros, paying with U.S. Dollars, or you sell Canadian Dollars for Japanese Yen. The value of your Forex investment increases or decreases because of changes in the currency exchange rate or Forex rate. These changes can occur at any time, and often result from economic and political events. Using a hypothetical Forex investment, this article shows you how to calculate profit and loss in Forex trading. Let's push your Forex trading education to a new level together.

To understand how the exchange rate can affect the value of your Forex investment, you need to learn how to read a Forex quote. Forex quotes are always expressed in pairs. In the following example, your pair of currencies is the U.S. Dollar (USD) and the Canadian Dollar (CAD). The Forex quote, USD/CAD = 170.50, means that one U.S. Dollar is equal to 170.50 Canadian Dollars. The currency to the left of the "/" (USD in this example) is referred to as base currency and its value is always 1. The currency to the right of the "/" (CAD in this example) is referred to as the counter currency. In this example, one USD can buy 170.50 CAD, because it is the stronger of the two currencies. The U.S. Dollar is regarded as the central currency of the Forex market, and it is always treated as the base currency in any Forex quote where it is one of the pairs.

Monday, November 13, 2017

CREATIVE 1

CREATIVE 2

CREATIVE 3

CREATIVE 4

CREATIVE 5

CREATIVE 6

FOREX DISCLAIMER

Trading foreign currencies is a challenging and potentially profitable opportunity for educated and experienced investors. However, before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. Most importantly, do not invest money you cannot afford to lose.

There is considerable exposure to risk in any foreign exchange transaction. Any transaction involving currencies involves risks including, but not limited to, the potential for changing political and/or economic conditions that may substantially affect the price or liquidity of a currency.

More over, the leveraged nature of FX trading means that any market movement will have an equally proportional effect on your deposited funds. This may work against you as well as for you. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. If you fail to meet any margin call within the time prescribed, your position will be liquidated and you will be responsible for any resulting losses. Investors may lower their exposure to risk by employing risk-reducing strategies such as 'stop-loss' or 'limit' orders.

VOLATILITY

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)

Nice article thanks for sharing such a valuable information with us.you may also check our blog for more information

ReplyDeleteState Bank of India MF

SBI Fixed Maturity Plan

Hey...Great information thanks for sharing such a valuable information

ReplyDeleteCanara Robeco Overnight Fund

Canara Robeco's NFO

Canara Robeco Mutual Fund